+91-9958 726825

Enhancing Educational Efficiency: Integrating ESG Criteria into Administrative Model

|

Integrating Environmental, Social, and Governance (ESG) basis in administrative models is gradually being demanded in all sectors highlighting the importance for sustainable development and responsible governance. In an area such as education, where the stakes are high for efficiency and effectiveness, the integration of ESG principles offers the promise of a solution to some walls we keep running into. It explores the benefits as well as the challenges involved in relegating ESG criteria in educational administrative models, and attempts to generate some insights through the secondary data analysis.

The incorporation of ESG criteria in educational governance represents a historic shift towards integrated organizational administration. Not only does it reduce the carbon footprints in educational institution by using green measures, but also conserves resources and teaches eco-aware values to students. Social factors, including diversity, equity, and inclusion, have also played a role. |

|

The dynamic changes in Environmental, Social, and Governance (ESG) basis for fabrication of governance into educational sector has embarked as a key factor to impetrate the face of fast changing terrain characterized by increasingly acute environmental challenges, entrenched social inequalities and an urgent requirement for high levels of transparency and ethical governance. Further, ESG factors are those that help assess sustainable as well as ethical performances of organizations along with their investments[12]. Recently, study on the ESG basis and corporate sustainability has gathered pace along with the evolution of new forms of production, consumption and societal expectations regarding the changes that have spurred this evolution[13]. As Clarkson wrote in 1995, companies had always been essentially about meeting the needs of stakeholder — customers therefore meeting up to the dynamic changes in the environment is essential[14].

As we embark on this exploration of the transformative potential of ESG integration in education, it becomes evident that this endeavor transcends mere operational optimization. It embodies a profound commitment to fostering a holistic environment to organizational management and prioritizes environmental supervision, social responsibility, as well as ethical governance. By embracing this paradigm shift, educational institutions accelerate towards sustainable, equitable, and resilient future, empowering individuals, along with communities to thrive the dynamic world. They include factors like: (i) Information collection (ii) solutions development (iii) ESG issues dealing with compliance and standard issues (iv) trainings (v) enhancing good communication[15]. Prevention and preservation of performance indicators are also illustrated using ESG basis[17]. Besides, coordination between environmental department, other departments within the organization, maintaining a balance between sustainable developmental goals and other corporate goals are required. ESG basis includes environmental, social, and governance factors for different investments and decision-making process involves conditional relevance to traditional financial metrics to analyze investments or valuations of an organizations[18]. Benefits of integrating ESG Criteria in Educational Administrative Model Ethical Leadership: Incorporating ESG criteria into educational administration cultivates a culture of integrity and responsibility, demonstrating ethical leadership principles to students, faculty, and staff. Operational Efficiency: By embracing ESG principles, educational institutions optimize resource use, reduce waste, and lower costs through sustainable practices in infrastructure, procurement, and operations. Risk Mitigation: Proactively considering ESG factors helps in identifying, analyzing and mitigating risk related to environment, social or governance issues, safeguarding the institution's reputation and financial stability. Reputation Enhancement: Prioritizing ESG criteria enhances the institution's reputation as socially responsible and environmentally conscious, attracting stakeholders who value sustainability and ethical conduct. Innovative Education: Integrating ESG principles into the curriculum fosters interdisciplinary learning, equips students with practical skills and knowledge to adhere sustainability challenges and become responsible global citizens. Stakeholder Engagement: Engaging stakeholders in ESG initiatives promotes transparency, accountability, and collaboration, strengthening relationships and fostering a sense of shared responsibility. Financial Performance: Strong ESG performance correlates with financial outperformance over the long term, providing financial benefits such as cost savings and improved access to funding from ESG-focused investors. Compliance and Standards: Integrating ESG basis ensures compliance with transforming regulations and standards, minimizing legal and regulatory risks aligning with best global practices. Community Impact: Educational institutions positively impact communities through ESG initiatives such as community service projects, partnerships with nonprofits, and advocacy for social and environmental justice. |

|

|

This study employs secondary data analysis as primary methodology. Existing literature, research papers, reports, and case studies related to ESG integration in education are reviewed to convene insights into the potential benefits, challenges, and outcomes associated with this integration. To prepare a thorough and transparent outlook of relationship between ESG in collaboration with administrative model of an educational institution, various guidelines are followed through systematic search and review.

First, it focused towards an exhaustive, comprehensive overview. Second, to know the benefits of Integrating ESG basis for quality assessment. Third, Core Values associated with ESG Integration. The analysis represents what is it known for, shortlists its limitations, and provide recommendations for practices |

|

Conduct a comprehensive review of existing literature, including academic journals, conference papers, reports, and policy documents, related to ESG integration in educational administration. This involves searching digital databases such as PubMed, Google Scholar, and institutional repositories for relevant articles and publications. Taking the references from European, Russian quality measurement standards, various universities’ models and also the companies of Korea, China and Germany analysis of administrative benefits through ESG integration in work culture has indicated that companies following ESG guidelines are with higher sustainability.

|

|

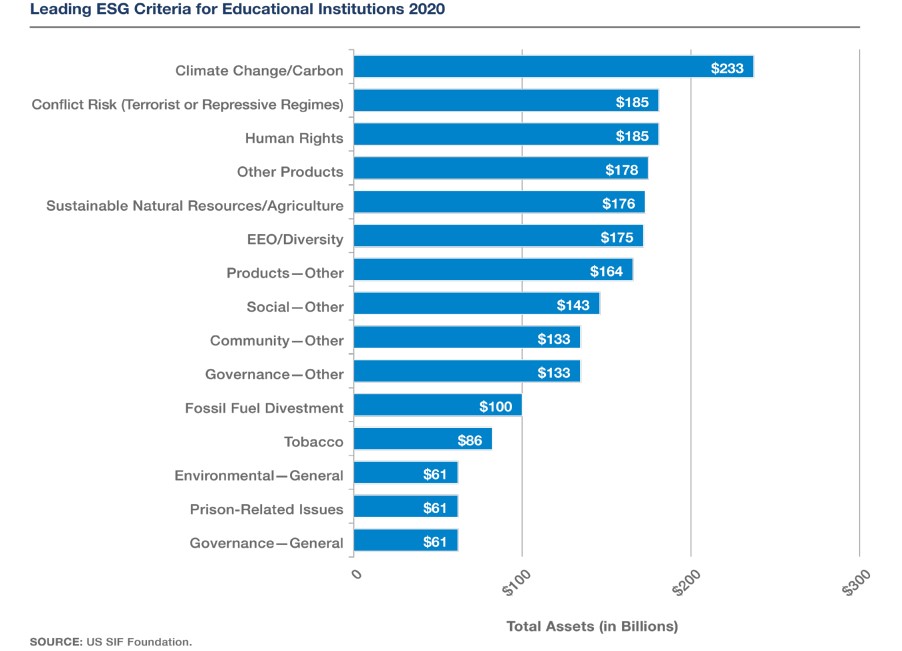

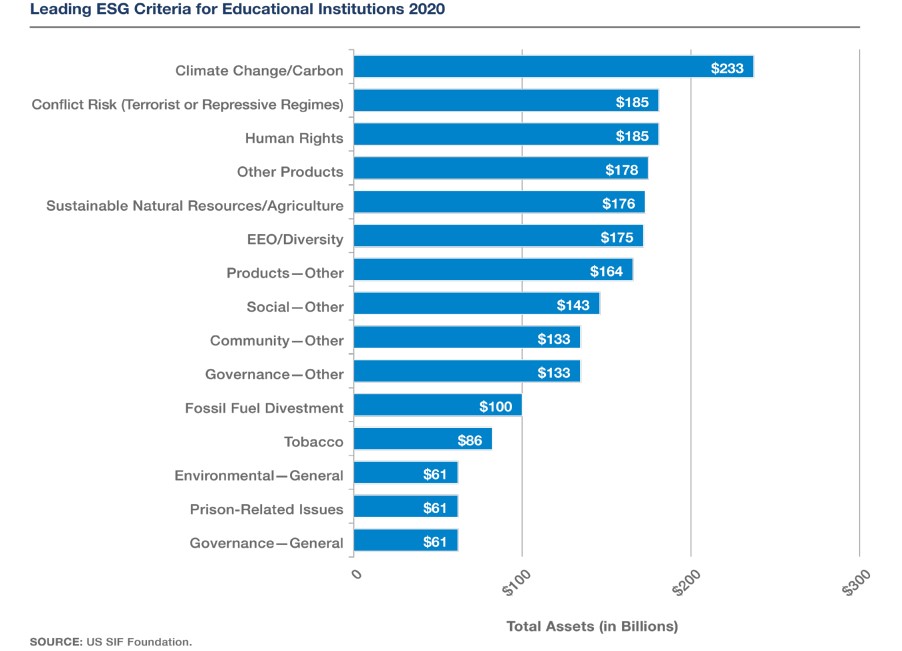

Case-I Sustainable investment in the United States expanded at rapid pace. Total US-domicile Assets under Management (AUM) incorporating ESG basis grew from $12.0 trillion in the year 2018 to $17.1 trillion in 2020, which results at 42 percent increase, which represents 33 percent or 1/3 dollar of total US asset under professional management in administration of educational institutes.

Figure 1 : Percentage of market capitalization owned by top Educational Investor in 2017 in leading educational hub countries.

As per the environmental factors in ESG organization carbon print is calculated. Tool to Estimate carbon emission - Microsoft Azure and Microsoft 365 cloud services can be used which targets decision making and help to create new efficiencies around cloud usage.

Microsoft Sustainability Manager is used to record, report, and reduce sustainability impact in environment which is available in two versions to meet customers’ needs like Essentials and Premium. To enhance sustainability, progress journey and business growth ESG tools like Microsoft and our global ecosystem are set  Figure 6 : Percentage representation on the use of Microsoft/Google in measuring ESG Case II The concept of ESG is fundamentally important in human resource management, especially while relating it with education systems. It is suggests, recruiters to increase diverse efforts for removing Grade Point Average requirements by acquiring candidates amongst lower-income sources to work along with attending college. It adds, more resources for relocation and interviews through generation of leadership role by facilitating technological assistance, which are not available to candidates. Further, trainings begins in higher education where students are informed and instructed to engage into experiential learning practices to prepare themselves as future leaders and contribute effectively towards business and industry with corporate boards, members of commissions, and other executive functions.

Below study proves how diversity leads to healthier and better decision-making organization.  Figure 7 : Various administrative model followed by educational institutes to incorporate ESG. As analyzed adopting the various administrative models followed by various educational institutions it is evidence that integrating ESG basis as criterion to enhancing educational efficiency in administrative model is highly effective if channelized appropriately considering the expected results and available resources of the educational institutions.

|

|

Findings

The results from the review of literature and secondary data analysis suggest several key insights regarding the integration of ESG basis into educational administration. Enhancing Educational Efficiency: Integrating ESG Criteria into Administrative Model represents a paradigm shift towards holistic organizational management. By prioritizing environmental considerations, educational institutions can reduce their carbon footprint, promote resource efficiency, and instill eco-conscious values in students. Social factors such as diversity, equity, and inclusion foster a conducive learning environment and nurture socially responsible citizens. Governance principles ensure transparency, accountability, and ethical decision-making, building trust among stakeholders. Multifaceted Impacts: The integration of ESG criteria into educational administrative models yields multifaceted impacts. Empirical evidence suggests that institutions embracing ESG principles exhibit enhanced operational efficiency, improved risk management, and heightened reputation, attracting diverse talent and fostering innovation. Moreover, aligning educational goals with sustainable development objectives prepares students to address complex societal challenges and contribute meaningfully to the global community. Challenges: Despite the benefits, integrating ESG criteria into educational administrative models faces significant challenges. Limited financial resources, educational organizations’ inertia, and resistance to change barriers for implementation. Additionally, the lack of standardized metrics and frameworks for assessing ESG performance complicates evaluation and benchmarking efforts. Overall, it is evidenced that underscore the transformative potential of integrating ESG criteria into educational administrative models while acknowledging the complexities and hurdles associated with implementation. Leveraging secondary data analysis, this research provides valuable insights about the efficacy in such integration and also emphasizes the need for concerted efforts to overcome obstacles and realize the vision of a more sustainable and efficient educational ecosystem. It can be stated that, adopting ESG basis into educational administrative models offers numerous benefits for educational institutions, including environmental sustainability, social cohesion, ethical governance, operational efficiency, innovation, educational excellence, and global citizenship. By embracing ESG principles, institutions can create more sustainable, inclusive, and ethical learning environment that prepares students to thrive in a rapidly changing world. |

|

|

Figure 1 : Percentage of market capitalization owned by top Educational Investor in 2017 in leading educational hub countries |

Figure 2 : Percentage of Budget allocation in institutes adopting ESG Criteria |

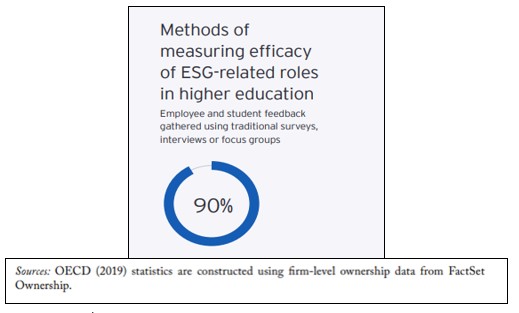

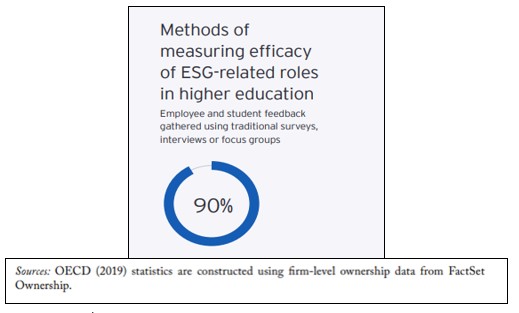

Figure 3 : Percentage to measure efficacy in institutes adopting ESG Criteria |

Figure 4 : Percentage of institutes having certified officers to administer |

Figure 5 : Investment rate of various countries on ESG Criteria in educational administration |

Pain Text:

Ankita Sarma, Dr Sharmila Sharan (2024), Enhancing Educational Efficiency: Integrating ESG Criteria into Administrative Model. Samvakti Journal of Research in Business Management, 5(2) 45 - 59.

Ankita Sarma, Dr Sharmila Sharan (2024), Enhancing Educational Efficiency: Integrating ESG Criteria into Administrative Model. Samvakti Journal of Research in Business Management, 5(2) 45 - 59.